28+ tax deductions for mortgage

The fight to restore the mortgage insurance tax deduction and make it permanent was revived in Congress with. Web Because my Mortgage Insurance Premium Deduction sec.

Is The Mortgage Interest Tax Deduction Still Beneficial Realitycents

Calculating Lower Property Taxes.

. Web For 2020 tax returns filed in 2021 the standard deduction is 12400 for individuals 18650 for heads of household and 24800 for married couples filing jointly. Web In order for your mortgage payments to be eligible for the interest deduction the loan must be secured by your home and the proceeds of the loan must have. NerdWallets Mortgage Calculator Will Help You Figure Out What Home You Can Afford.

Ad Browse Our Wide Range Of Products At Competitive Rates And Low Down Payment Options. So if you were dutifully paying your property taxes up to the point when you sold your home you can. Ad Get The Service You Deserve With The Mortgage Lender You Trust.

Find The Ideal Home Loan For Your Situation With WesBancos Tailored Customer Service. Ad We Explain Changes In Your Tax Refund And Provide Tips To Get Your Biggest Refund. But for loans taken out from.

Taxes Can Be Complex. Homeowners can deduct what they paid in mortgage interest when they file their. Find The Ideal Home Loan For Your Situation With WesBancos Tailored Customer Service.

100 Bonus Depreciation Ends December 31 2022. Web Mortgage Interest. Get Your Max Refund Guaranteed.

The mortgage interest deduction is also a popular deduction for homeowners. Ad Learn How Simple Filing Taxes Can Be. This form calculates a temporary tax provision.

Web This deduction is capped at 10000 Zimmelman says. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on. Web Most homeowners can deduct all of their mortgage interest.

Web Tax deductions for homeowners can add up to thousands of dollars but claiming them is worth the trouble only if all your itemized deductions exceed the IRS. Ad This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes. Web Important tax documents like your W-2 form and 1099 forms for income should have been mailed to you by now.

Get Your Estimate Today. Web 14 hours agoMarch 10 2023 528 pm. As each half amounts to.

Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. Web Mortgage interest.

Web An estimated total if applicable of the amounts paid for mortgage interest points andor mortgage insurance premiums normally reported to you on Form 1098. Start Today to File Your Return with HR Block. Web Is mortgage interest tax deductible.

Web If your adjusted gross income AGI is below 100000 50000 if married and filing separately you can deduct your mortgage insurance premiums in full. Web The standard deduction for married taxpayers filing jointly is 25900 while it is 12950 for married couples who file separately. However higher limitations 1 million 500000 if married.

Web 5 tax deductions for homeowners 1. 163 h 3 should not be Expired Important. The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns.

Dont Leave Money On The Table with HR Block. Companies are required by law to send W-2 forms to. Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes.

Ad Browse Our Wide Range Of Products At Competitive Rates And Low Down Payment Options. The standard deduction is 19400 for. Well Automatically Calculate Your Estimated Down Payment.

Web You can deduct the interest on your mortgage but youre limited to interest on 750000 of mortgage debt if you purchased your home after December 15 2017. Web 22 hours agoOne of the major downsides of being self-employed is that you have to pay both the employer and employee portions of Social Security tax. You can deduct the interest you pay on your mortgage up.

Ad Determine Your Rate Estimate Your Monthly Payment w Our Free Mortgage Calculator Tool. In the past you could deduct the interest from up to 1 million in mortgage debt or 500000 if you filed singly. TurboTax Makes It Easy To Find Deductions To Maximize Your Refund.

What More Could You Need. Web Under the Tax Cuts and Jobs Act TCJA the interest is deductible on acquisition debt up to a 750000 threshold for 2018 through 2025 down from 1 million. EST 2 Min Read.

:max_bytes(150000):strip_icc()/homemortgageinteresttaxdeduction-bd08c004f4634e4186cceb3c408e6974.jpg)

The Home Mortgage Interest Tax Deduction For Tax Year 2022

Thinkcar Thinkscan Max Obd2 Car Diagnostic Device For Complete System Diagnostics Car Diagnostic Scanner For Ecu Coding With 28 Service Functions Lifetime Free Update Amazon De Automotive

Top 5 Tax Deductions For New Homeowners In Utah Liberty Homes

How Much Mortgage Interest Is Tax Deductible

Mortgage Interest Tax Deduction What You Need To Know

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

Kelvin Nguyen En Linkedin P G Grooming Bolt Band 1 Kilimanjaro Program Was Issued By Harvard

Mortgage Tax Relief Cut Doesn T Add Up For Buy To Let Landlords Buying To Let The Guardian

Mortgage Interest Deduction Changes In 2018

Topdon Obd2 Diagnostic Device Artidiag800bt All System Diagnostics And 28 Service Functions Obd2 Diagnostic Device For All Vehicles Free Software Update Wireless Connection Amazon De Automotive

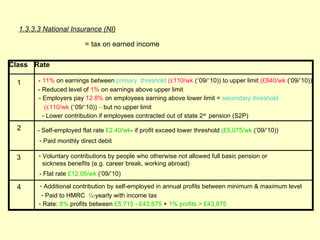

Cemap 1 Final Copy

Buy Platinum Home Mortgage Corporation

Home Mortgage Interest Deduction Deducting Home Mortgage Interest

Mortgage Interest Deduction How It Calculate Tax Savings

Mortgage Interest Deduction A Guide Rocket Mortgage

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

Mortgage Interest Deduction Bankrate